For many newly qualified doctors, the idea of opening a practice can be as tempting as it is daunting, as in addition to all the medical issues involved, there are also financial and accounting issues that need to be considered.

Working as a service provider makes it easier for you to have control over your schedule and income, as well as the ability to provide personalized services to your patients, clinics and hospitals. However, for the dream to come true, it is necessary to deal with many doubts and challenges, especially in the accounting area.

Thinking about clarifying some of these doubts, we separate some practical and valuable tips that will help you, a newly graduated doctor, to manage the accounting of your own office. Read on!

Plan your budget

The first step is to create a realistic budget according to your possibilities. It should include fixed costs such as rent, equipment, accounting services, insurance and payroll, as well as variable costs such as medical supplies, advertising and day-to-day operating expenses. Make sure you also set aside an amount for emergencies and unforeseen circumstances.

Register your company

To open a medical practice, it is necessary to register it as a company. You can choose to register as a sole proprietorship, limited partnership or limited liability company. Each structure has its own advantages and disadvantages, so it’s important to consult one of our accountants to choose the best option for your style of business.

Keep documents and records

Keeping all documents and records of this process is critical to the success of your business. This includes financial records such as expenses, income and tax payments, as well as your patients’ medical records. Keeping these records in order can help ensure that your practice is in compliance with local and tax regulations.

Choose a financial control system

There are many software programs controle financeiro available that can help you manage your practice’s finances. They can help track expenses, income, tax payments and other financial transactions. It is important to choose software that is easy to use and understand , that is suited to your specific needs.

If you are not familiar with software and need help with this, do not hesitate to contact a specialized accountant to help you.

Hire an accounting firm

While technology can be very helpful in managing finances, nothing replaces the expertise and guidance of a professional accountant. They can help ensure your practice is in compliance with local tax regulations, as well as advise on tax strategies to reduce your tax burden. Contact us!

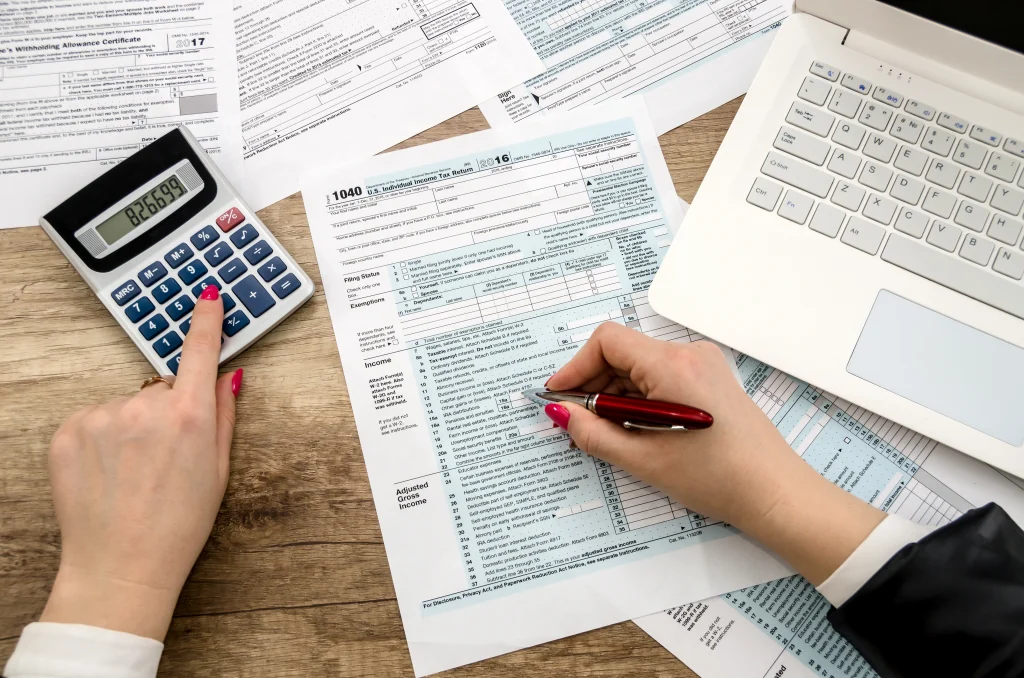

Understand tax obligations

As a medical practice owner, it’s critical to understand all of your tax obligations. This includes paying income and payroll taxes, as well as complying with other state and local tax regulations. Consult an accountant to ensure your practice is in compliance with all tax obligations and protected from legal damages and tax losses.

Opening a medical practice can be a challenge, but with careful planning and professional guidance, it can be a very rewarding experience. By following these tips, you will be safer on the paths to achieve business success and offer a differentiated experience to your patients. Good luck!

Conmax manages your company’s accounting safely and reliably!

Headquartered in São Paulo and Fortaleza, but operating directly in several states of the country, we are certain that we are adding value to new clients, helping them through business accounting to further develop their businesses. We have a select team composed of more than 25 accounting professionals, continuously trained and post-graduated in several areas of activity to better meet the demands of our Clients.

If you are having difficulties with your company’s accounting, don’t waste time and talk to our customer service now. Be another company positively impacted by our service !!!